Future Forward: A Special Report on Preparing for the Next Normal

The next wave of our longitudinal study on how a pandemic impacts the life science community

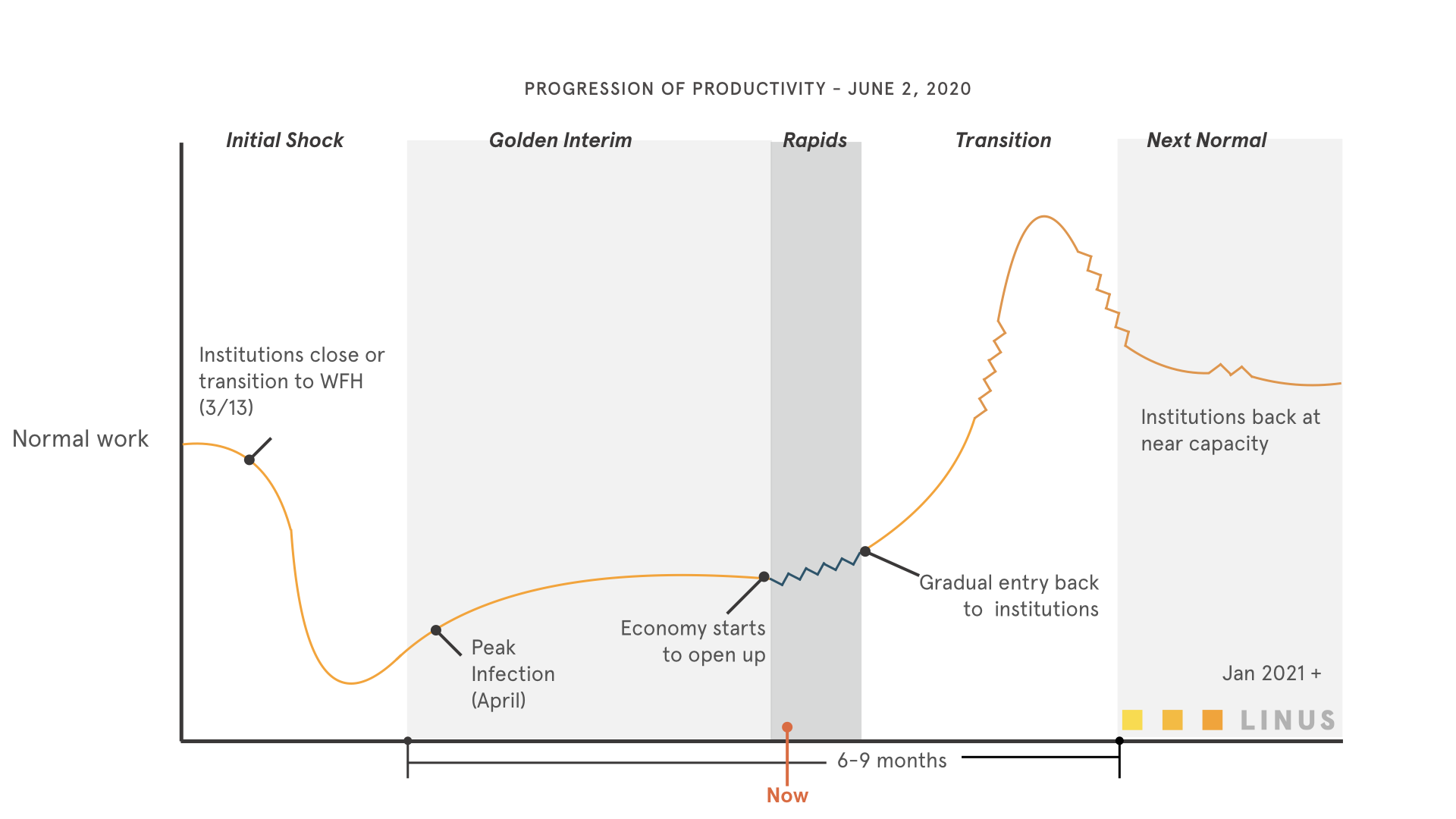

It’s been over two months since the World Health Organization declared COVID-19 a pandemic. And in those two months, The Linus Group surveyed over 2,400 members of the life science industry and wrote two reports on exactly how the pandemic will leave a lasting impact on our community. Our model on the Progression of Productivity is being used by leaders across the industry to inform strategic planning.

With many regions around the world reopening, we know this transition phase will make a lasting impact on the success of the life science community. Our current tranche of data, collected between May 19-25, 2020 measures sentiment, impact, productivity and provides insight into what the life science industry is doing now to prepare for the next normal.

This summary explores the life science community’ overall sentiment during the pandemic, what long-lasting change they are anticipating and what innovation they hope to initiate after their initial transition to the office or lab.

Today, the pandemic is still causing major disruptions to the work and personal lives of the community organizations will need to fundamentally shift their operations in order to adapt. In our early research, a model emerged, showing the progression of productivity on scientific progress in five periods: Initial Shock, Golden Interim, the Rapids, Transition and Next Normal.

Regardless of what future scenarios might emerge, those who can plan for these phases of the disruption will be better prepared to shape the Next Normal.

ABOUT OUR MOST RECENT STUDY

We collected data from 463 respondents across the globe during May 19-25, as the economy and industries open and “safer at home” laws ease and allow for the population to go back to work, in accordance with social-distancing guidelines.

ABOUT OUR RESPONDENTS

Over half (59%) of our respondents work in academic institutions and government research. Another third (34%) work in industry such as (pharma, biopharma and manufacturers of life science products) and the final 7% work within clinical organization (healthcare facility or hospital system). Of those respondents, 80% work in research and development and 38% are in leadership or management roles at their respective organizations.

83% of our respondents are located within North America, another 13% from Europe and 4% replied from the rest of the world, including Asia/Pacific, India, South America and Australia.

PART I: REPORT RESULTS

Professional sentiment about the pandemic

In earlier reports of our study, we found that pessimism continued to outpace optimism until early April. By May 25, there was a major shift in sentiment toward optimism, where optimism rose to 52%.

For our respondents who come from industry-related organizations, we’ve seen optimism rise from 37% in mid-April to 70% by mid-May, while pessimism remained the same during this time. In Academia, the gains are smaller, but there are now as many respondents who feel optimistic as they do pessimistic, at 39%.

Current mindset

When we asked respondents which mindset reflects their current state (disrupted, chaotic, stressed; acclimating, planning, pensive; or innovative, positive), nearly 20% of respondents still felt stuck in the “disrupted” mindset. However, there is a growing number of respondents who feel they are in the ‘innovative’ mindset (28%), suggesting a widening gap between those who are moving on and those who aren’t able to get unstuck.

When we look at this data from an industry versus academic/government perspective, those in industry are about half as likely to be in a disrupted mindset and nearly twice as likely to be in an innovative mindset.

Impact on Productivity and Scientific Progress

At this point in the COVID-19 transition period, it appears that the most widespread disruptions to productivity are fading. From our earlier report, we found that the most impact on productivity occurred between March 23-April 4. By May 25, respondents said that they were somewhat or more productive rose to 17% from 8% and respondents who were much less or not productive at all dropped from 39% to 49%.

As it relates to disruptions to scientific progress, disruption peaked in late March through mid-April. In our latest study, we found that this description is steadily dropping from mid-April to present. Currently, only 26% of scientists in industry are experiencing severe interruptions to progress, compared to 58% of those in academia and government.

Virtual Learning

When we asked respondents if they have attended any virtual conferences or events, 64% of respondents said yes. So far, those in administrative roles (78%) are much more likely to be attending virtual events, compared to those in research and development roles (62%).

For those in R&D roles who have attended virtual events, the most appealing aspects have been the convenience to fit it into daily schedules, the opportunities to engage with distant collaborators, the ability to review it afterward, and the lower cost or fee to participate. For those in administrative roles, they said that the most appealing aspects include not having to travel, learning from experts from around the world, the flexibility in when to watch and high attendance as the most appealing aspects.

And while virtual attendance may seem to be on the rise, it still comes with its setbacks. For those in R&D roles, the least appealing aspects include: limited discussion and Q&A time, not being able to interact with new or familiar faces, and technology issues.. For those in administrative roles, the fewer personal connections and network opportunities, reduced dialogue with speakers and the inability to stay engaged are the least appealing aspects of virtual events.

When we asked respondents if any life science or industry-related companies were particularly helpful resources during the pandemic, only a third (34%) said yes. Of those 34%, respondents expressed gratitude to organizations that provide education, continue to fulfill their commitments, and provide excellent service. Those companies ranged from Thermo Fisher Scientific, who have hosted useful webinars and provided technical expertise, to MilliporeSigma, who is able to supply organizations in a timely fashion, to Johns Hopkins and their COVID-19 tracker.

Looking to the Future: Conferences, Lab Visitors, and Funding

As respondents think about the next time they will attend an in-person event, our study found that it will almost be a year before the community is ready to go to a trade show or event. Between now, and mid-May of 2021, the number of respondents who are unlikely to attend a conference or event in person far exceeded those who responded that were likely. Nearly two-thirds (66%) of respondents stated they are likely to attend an event by mid-May of next year.

Visiting the lab will be a different experience. 85% of respondents said they expect changes in the number or frequency of visitors at their labs or facilities. Those visits will likely include screenings at the door for fevers and required PPE wearing.

One respondent said:

"The lab will become much less inviting to everyone—I expect students to be the most impacted."

Leaders in academia are nearly as twice as likely as those in industry to expect a funding/budget decrease, at 51%. And those in Industry are twice as likely to expect a funding increase.

Purchasing and Interest in New Instruments

Regarding re-supplying, the most commonly mentioned category is PPE, with over half of respondents mentioning it in some form. As far as resupply priorities, our respondents also said they’ll be purchasing reagents, enzymes and chemicals; cell and cell culture supplies; pipettes, consumables and disposables; and antibodies.

Of our respondents, a quarter of them said that they are currently making purchasing considerations regarding new innovations and instruments.

Defining the Next Normal

As the economy opens back up and people begin to go back to work, we wanted to understand how respondents would define what “normal” work will look like once they transition back.

We found that only a small subset of respondents expect normal to be a return to what they’ve known before. The vast majority (82%) believe that achieving the next normal will require adaptation to very real changes.

Regarding when things will feel normal at work again, over half of our respondents said by the end of the year.

However, the next normal will not exist without significant, long-lasting changes. And most of those significant changes are a direct impact of what it takes to keep staff safe. This manifests in more sanitation, more social distancing, more remote work and a lot less face-to-face interactions or conversations.

Some of our respondents said:

"I believe that many will continue to remotely work while essential workers such as myself will bear the brunt of operating in this new world.”

“Loss of personal and group interactions critical for the scientific process. Zoom just does not cut it when it comes to dialectic discussions.”

“Fewer people and almost no face-to-face interactions or smiles.”

"I return to work the week of June 15th. Our lab has ten members, yet we are only allowed to have one person per bench lane, meaning only three can work at any given time. Thus, I can only work two full days per week until restrictions are lifted. I cannot imagine how I can be any way near as productive under such conditions.”

There is a positive sign for future innovation — when we asked our respondents what changes they plan to make after their initial transition back, nearly half said they are planning to change their normal practices and ways of working. Other areas to change for the next normal include: trying new techniques, using more technology that can be operated remotely, digitizing more information and data, and exploring a new research area or focus topic.

The Five Periods of Progression through a Global Pandemic

Using our data, we developed a prospective model to illustrate the likely progression of productivity in the life sciences community as a result of disruptions caused by the novel coronavirus. We’ve found that there are five phases, each with its own set of characteristics, priorities and duration that help track progress during this time. Those phases are: Initial Shock, Golden Interim, Rapids, Transition, and the Next Normal.

Characteristics of Each Period

Initial Shock

As suggested in our model, life science professionals have emerged from this phase to enter the Golden Interim. In this period the community focused on family, social distancing and worrying about how to stay healthy and simply get through each day. This phase was marked by abnormally high states of anxiety, disbelief and worry.

Golden Interim

Though our respondents claim that they will be productive during this interim period, activities during this time will be different from business-as-usual times. During this unique and unprecedented period, the life science community is taking a more pensive and reflective inventory of their work by focusing on planning, writing manuscripts and experiments, submitting their publications and grant applications, analyzing data, and sharing data-sets with other scientists to forge new collaborations and new discoveries.

The Rapids

Before our industry can enter the Transition Period, we expect to experience a short, but acute phase of chaos, uncertainty and pessimism due to the confusion of whether, when and how to re-enter the workforce. This phase will be marked by our ability to navigate obstacles and dangers — all while being forced forward into the Transition period as the economy and institutions re-open.

Transition

In this period, we anticipate a surge of activity — as well as grace for adaptations — as the life science community scrambles to re-enter work with their full capabilities. For those that focused on planning, retaining customer relationships and maintaining or protecting supply chains during the Golden Interim, we expect to see a significant jump in productivity as business ramps back up. Lagging organizations will be focused on relieving or attending to the backlog and stuck in outdated procedures and ways of working. The duration of this phase could range from one month to 18 months depending on the nimbleness and readiness of the organization.

Next Normal

Once the surge of activities from the Transition Period ends, this phase will likely be driven by market psychology caused by the rippling effects the coronavirus will have sent through our society as a whole. We anticipate that big winners and losers will emerge as a result of this overall disruption, the winners shaping the Next Normal.

Part II: Report Synthesis

Where We Are Now

As of the publishing of this report, June 10, 2020, we believe that the life science community is in the Rapids phase. We’re seeing the industry open back up as it anticipates the adaptation it needs to prepare for the transition and Next Normal. Scientists, researchers and managers are navigating exactly how to re-enter the workforce, defining the parameters of safely working from a lab, office or facility, and finding new ways to innovate and collaborate as we surge forward into the next normal.

Moving Forward

It’s clear that there are some major disruptions in our near future. As a community, we need to be prepared for a fundamental shift in the way we operate our commercial organizations.

We’ve found that there are three types of organizations operating in the pandemic:

Organizations who need to survive

The reality for organizations in this group is that they’ve likely halted any product launches and simply need tactics to survive and ensure revenue is unaffected. These organizations need to engage their lead pipeline and move customers who are stuck in the mid-funnel.

Organizations who will strive

With organizations in this group, it’s likely that they put their 2020 plans on hold, and now their competitors are innovating, moving the needle, and neutralizing the playing field. It’s important for this group to engage with key customers and move forward with launches that were put on hold in the beginning of the pandemic.

Organizations who will shape

This last group of organizations are those who are disrupting current business models and acting as change agents when it comes to reshaping their commercialization and innovation strategies. This group of companies will shape the next normal in their industry.

In Summary

Optimism is rising, progress in scientific research is picking up, and the life science community as a whole is figuring out just what this next normal looks like.

While the state of the pandemic shifts daily, organizations that can weather this current Rapids Period will be poised to successfully navigate the Transition Period. Knowing whether or not your organization needs to survive, plans to strive for the transition, or shape the Next Normal, will define how your company emerges from this pandemic.

Want to learn more about understanding your critical uncertainties, how to scenario plan or want to be a part of shaping the Next Normal? Let’s talk. Reach out to us at hello@thelinusgroup.com.